The IRS has revealed the 2026 federal income tax brackets, which include inflation adjustments and new income thresholds. These changes will affect how much tax you pay in 2026 (for returns filed in 2027).

2026 Tax Brackets at a Glance

Here’s a simplified table for Single and Married Filing Jointly filers:

| Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|

| 10% | $0 – $11,925 | $0 – $23,850 |

| 12% | $11,926 – $48,475 | $23,851 – $96,950 |

| 22% | $48,476 – $103,350 | $96,951 – $206,700 |

| 24% | $103,351 – $197,300 | $206,701 – $394,600 |

| 32% | $197,301 – $250,525 | $394,601 – $501,050 |

| 35% | $250,526 – $626,350 | $501,051 – $751,600 |

| 37% | Over $626,350 | Over $751,600 |

(Thresholds and rates based on the IRS’s latest announcement.)

What’s New & Why It Matters

- The standard deduction also rises — $16,100 for individuals and $32,200 for married couples.

- The top marginal rate of 37% remains, but the income level at which it kicks in is now higher.

- Due to inflation adjustments, many middle-class households may experience slightly lower effective tax burdens.

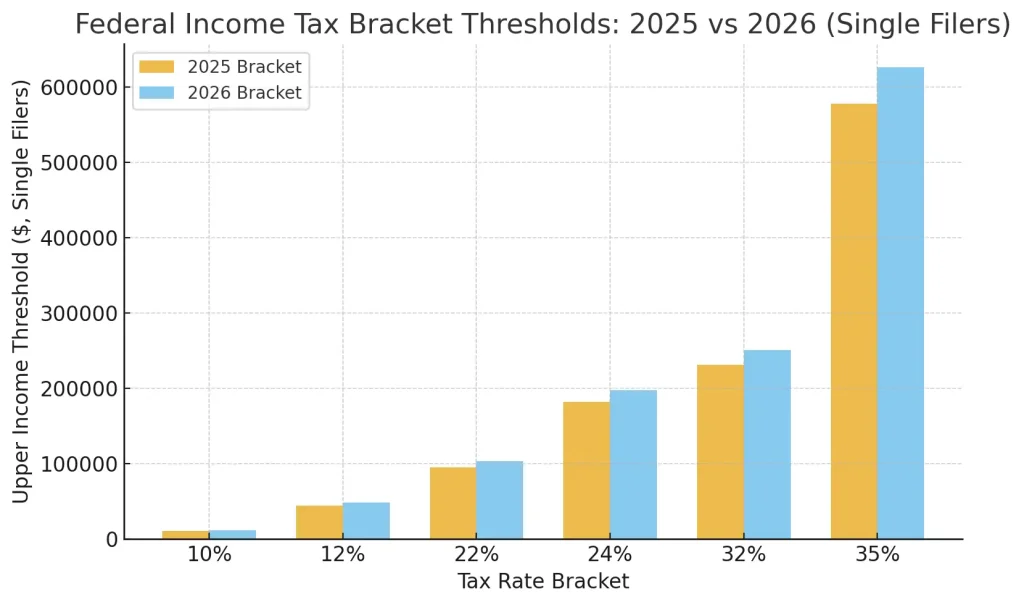

Federal Income Tax Bracket Changes from 2025 to 2026 (Single Filers)

“Bar chart comparing IRS 2025 and 2026 tax bracket upper limits by percentage for single filers.”

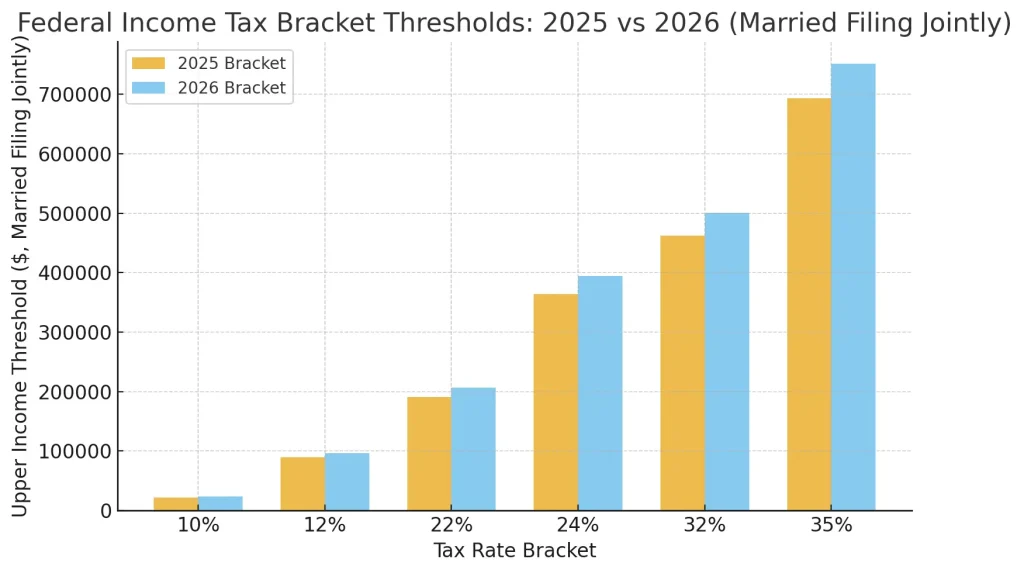

Graph: Federal Income Tax Bracket Changes from 2025 to 2026 (Married Filing Jointly)

Bottom Line

These 2026 bracket adjustments give many taxpayers a bit more breathing room, especially in lower and middle brackets. But higher earners may still feel the pinch if their income pushes them deeper into the top tier. Use the new thresholds to revisit your withholding, tax planning, and savings strategies before filing season 2027.